3 Financial Statements You Need to Know in Your Business

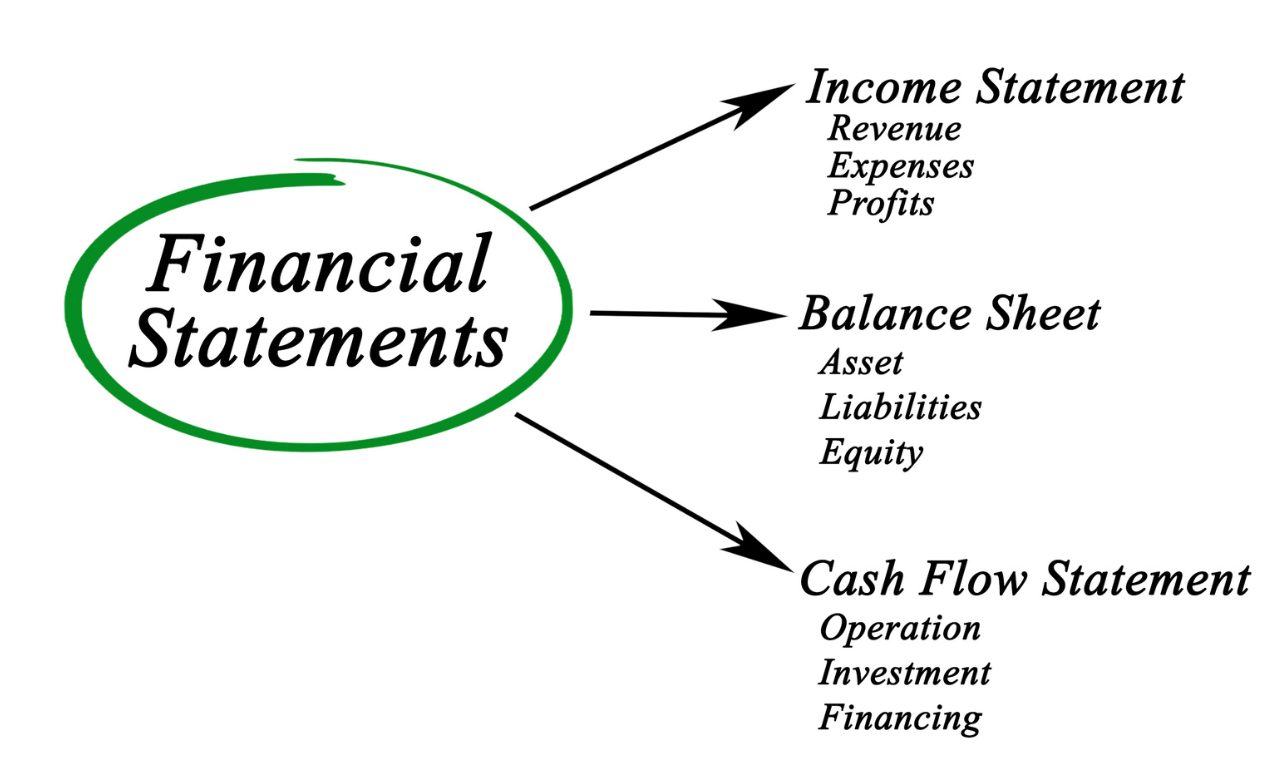

Financial statements represent the financial health of your business. As a business owner, you need to be familiar with these three financial statements to help you effectively manage your business.

- Balance sheet

- Income statement

- Statement of cash flow

When your business is seeking financing from a lender, looking for capital, or if you are selling your business, investors and bankers will want to see these three financial statements to assess the value and going concern of your business.

For business owners, using these three financial statements is helpful in you determining the financial health and position of your business. When you read and understand these financial statements, you get valuable feedback on your business's performance. With that feedback, you can adjust to help the business perform better.

A business finance coach can help you understand how to read your financial statements and interpret the results. Your financial statements provide the necessary information to make profitable decisions, so ensure you know how to read yours.

What are financial statements?

Financial statements report on the fiscal performance of a business. Financial statements are used by business owners and financial professionals who want to assess a business's financial performance and earnings potential.

Many small business owners fear looking at their financial reports because they fear what that information will tell them. But they fail to realize that by reviewing your monthly financial reports, you will assess where you can improve your financial performance.

How to read a balance sheet

A balance sheet will tell you how much equity your business has.

EQUITY = ASSETS - LIABILITIES

Balance sheets can be tricky to read, but with a bit of practice, they can be highly informative. The balance sheet is a financial statement that shows a company's assets, liabilities, and equity.

The first thing to look at is the asset side of the balance sheet. This includes all the company's things, such as cash, inventory, and property. Then, look at the liability side. This includes all of the money that the company owes, such as loans and credit card debt. Finally, look at equity. This is the difference between assets and liabilities - it's what the company is worth.

Equity can come from investment, retained earnings, or other sources. With a bit of practice, balance sheets can be a great way to get a snapshot of a company's financial health.

What is an income statement?

An income statement is likely your most used financial statement.

An income statement is one of a business's most important financial statements. It shows a company's revenues and expenses over a period of time, typically one year.

The income statement can be used to help assess a company's financial health and make predictions about its future performance. The income statement starts with revenue, which is deducted to reach net income. This number can be further divided into operating income and non-operating income.

Operating income is a measure of a company's profitability from its core business activities, while non-operating income includes items such as interest and investment income. The income statement also shows expenses, divided into the cost of goods sold and operating expenses.

The cost of goods sold includes the costs associated with producing the goods or services a company sells. Operating expenses are all the other costs that a company incurs in running its business, such as marketing and administrative expenses. By subtracting these expenses from revenue, we determine the bottom line: net income. This number can be positive or negative, depending on whether a company made or lost money during the period covered by the income statement.

Income statements are an essential tool for financial analysis and decision-making. They can assess a company's overall financial performance, compare companies in the same industry, or evaluate how well a company uses its resources.

What is a statement of cash flow?

A statement of cash flow is a financial statement that provides a detailed overview of a company's cash inflows and outflows over a given period of time.

The statement is typically divided into three sections: operating activities, investing activities, and financing activities. Operating activities include cash generated from day-to-day business operations, such as sales, collection of receivables, and payment of expenses.

Investing activities include cash inflows and outflows related to long-term investments, such as purchasing or selling property, plants, and equipment. Financing activities include cash inflows and outflows related to the issuance and repayment of debt and equity.

The cash flow statement can be prepared using either the accrual or cash methods. Under the accrual method, cash inflows and outflows are classified based on earned or incurred, regardless of when they are received or paid.

Under the cash method, cash inflows and outflows are classified based on when they are received or paid, regardless of earned or incurred.

How financial statements help you

Financial statements are one of the most essential tools available to business owners. By tracking income, expenses, and other financial activity, statements can give owners a clear picture of the health of their business.

This information can be used to make important decisions about where to allocate resources and how to grow the business. For example, owners may need to reconsider their pricing strategy or marketing budget if income is trending downward.

Financial statements can also help identify areas of waste or fraud. By keeping careful track of financial activity, business owners can ensure that their business is on track and making the most of its resources.

The bottom line is that financial statements must be integral to your business acumen. Want to learn more about what you need to know as the CEO of your business when it comes to financial management? Download the 5-Step Roadmap to a Profitable Biz now!